Tony Abbott has argued that “Coal is good for humanity, coal is good for prosperity, coal is an essential part of our economic future, here in Australia, and right around the world.” It seems, however, that a growing majority of Australians disagree with him.

Australia is particularly vulnerable to climate change and to actions to address it because of the carbon intensive nature of its export structure.[1] Increased use of renewables will decrease demand for fossil fuel exports. The International Energy Agency reports that

The Abbott government remains wedded to the view that a resource-based economy can continue to underpin prosperity in Australia; that climate action is largely unnecessary and that the economy will seamlessly transition to a more diverse export structure. The solution, according to Treasurer, Joe Hockey, is smaller government:

With rising concern about pollution and climate change, it is perhaps more urgent than ever to increase the diversity of Australia’s productive capacity and export profile. However, in the arena of renewable technologies and pollution reduction, Australia under the Abbott government has chosen to retreat. The government has abolished a carbon price, cut funding to the CSIRO by $110 million, rushed approval for risky coal mines in Queensland, defunded the Climate Commission, and attempted to cut the Renewable Energy Target and abolish the Clean Energy Finance Corporation. Its direct action plan pays polluters to pollute less instead of taxing them. Overall, the government has been hostile to the development of the renewable energy sector.

The one saving grace may be that opinion polls such as those below will eventually force change within the Coalition.

Australia is particularly vulnerable to climate change and to actions to address it because of the carbon intensive nature of its export structure.[1] Increased use of renewables will decrease demand for fossil fuel exports. The International Energy Agency reports that

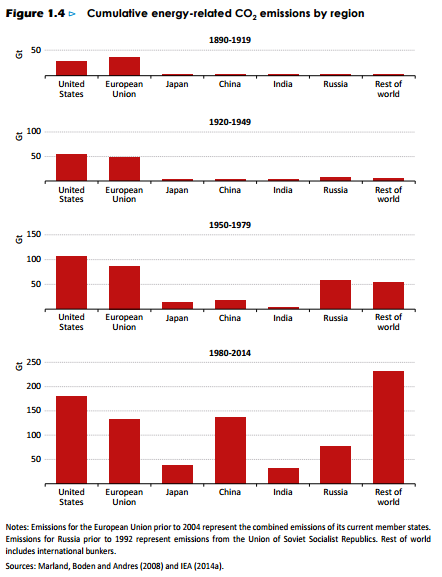

The global economy grew by around 3% in 2014 but energy-related carbon dioxide (CO2) emissions stayed flat, the first time in at least 40 years that such an outcome has occurred outside economic crisis. Renewables accounted for nearly half of all new power generation capacity in 2014, led by growth in China, the United States, Japan and Germany, with investment remaining strong (at $270 billion) and costs continuing to fall. The energy intensity of the global economy dropped by 2.3% in 2014, more than double the average rate of fall over the last decade, a result stemming from improved energy efficiency and structural changes in some economies, such as China.[2]Former Treasury Secretary, Martin Parkinson argues that “climate change will result in risks to our food and water supplies and damage from severe weather events, while other countries response to changing conditions may threaten our industries, with consequent effects on jobs, exports and living standards.”[3]

The Abbott government remains wedded to the view that a resource-based economy can continue to underpin prosperity in Australia; that climate action is largely unnecessary and that the economy will seamlessly transition to a more diverse export structure. The solution, according to Treasurer, Joe Hockey, is smaller government:

We face a number of challenges across a range of areas such as growth and productivity, demographic trends and fiscal sustainability. But we have a road map to deal with those challenges. We will begin by reducing the size of government. We will cut taxes, eliminate the carbon and mining taxes, cut the company tax rate, and deliver personal income tax cuts without the carbon tax. We will reduce the burden of regulation on individuals and on business.[4]When in doubt appeal to a cliche that gets the faithful salivating.

[1]

Pilita Clark “Renewable Power Will

Overtake Coal if Climate Pledges are Kept”, Financial

Times, 15 June <http://www.ft.com/intl/cms/s/0/43c8d800-1119-11e5-a8b1-00144feabdc0.html>;

Kate Mackenzie (2015) Australia’s

Financial System and Climate Risk, Discussion Paper, July, The Climate

Institute <http://www.climateinstitute.org.au/verve/_resources/TCI_Australias_Financial_System_and_Climate_Risk_FINAL.pdf>.

[2]

International Energy Agency (2015) Energy and Climate Change, World Energy

Outlook Special Report <http://www.iea.org/publications/freepublications/publication/WEO2015SpecialReportonEnergyandClimateChange.pdf>.

[3]

Cited in Sid Maher (2015) “Australia’s

Financial System ‘Vulnerable’ to Climate Change”, Australian Financial Review, 13 July <http://www.theaustralian.com.au/business/financial-services/australias-financial-system-vulnerable-to-climate-change/story-fn91wd6x-1227439210953>.

[4]

Joe Hockey (2013) “The Task Ahead”, Address to the Centre for Independent

Studies, Sydney, 8 November <http://jbh.ministers.treasury.gov.au/speech/002-2013/>.

See also Joe Hockey (2014) Address to Australian Institute of Company

Directors’ Annual Dinner, Adelaide 6 November <http://jbh.ministers.treasury.gov.au/speech/024-2014/>.