I love listening to football player interviews after a game. My favourite response is the phrase "yeah, naah". In other words, I understand what you're saying, but I'm not sure if you're right (or maybe I haven't understood the question or even know what my name is after that hit to the head in the final quarter).

While many might think it's a rather silly response I think it's a reasonable appraisal of many things in life, including that most interesting of topics: the Australian economy. Yeah we've been doing well, but naah I'm not sure it's going to last or that we've prepared properly for the inevitable downturn.

A recent speech by Reserve Bank Governor Glenn Stevens using the increasingly hackneyed phrase "the Lucky Country" attracted considerable attention in the Australian press. Reserve Bank governors like the rest of us, like to hedge their bets so while most comment focused on the Guv's optimism, some noted the warnings contained in the speech as well.

Better to cover all bases so that if a crisis comes the Guv can point to his notes of caution. If things continue to go well, then of course he can point to his overall regular message of optimism.

Before we consider Stevens yeah naah interpretation of the Australian economy, I want to begin with a few general observations.

- Australia has been lucky, but also relatively good on the issue of economic management since the mid-1980s. Lots of mistakes have been made but the direction and pace of change has been effective to sustain reforms.

- The Australian economy has not been in recession for 21 years - very few of my students have any concept of a sustained downturn in the economy. According to economist Chris Richardson this is a world record. Perhaps this is another reason why the government is doing poorly, "success fatigue".

- Seriously, though, some Australians aren't doing as well as others and, in an attempt to rectify this, the Gillard government has made some progress in redistributing income in Australia.The Howard government was also a big redistributor of income, mainly to families.

- Australia will be negatively affected if Chinese growth slows - both directly and indirectly through flow on effects to other Australian trading partners e.g. Japan will be hurt and so Australian exports to Japan will slow as well. And so on. This implies that both industrial and geographical diversification will serve Australia well over the longer-term.

- Part of any diversification strategy for the Australian economy doesn't just include manufacturing and services but agriculture as well. Foreign ownership of farm land is about 6% (1% of agricultural businesses are foreign owned and 11.3% of agricultural land is wholly or partly foreign owned, although more than half of this land was majority Australian owned). Developing the agricultural sector in Australia will require foreign investment, some of it from China. Why people worry so much about farming, but ignore the fact that mining is over 80 per cent foreign owned continues to surprise me. While you might be able to damage farmland through poor farming practices, foreign investors won't be shipping the land out, like they are with minerals, petroleum and gas. One thing is for sure, demand for agricultural goods is going to expand over coming years and Australia will need to manage these developments, especially through the next drought period.

- The European crisis is not going to end any time soon and will probably end up with financial upheaval as Greece and/or Spain eventually abandon the Euro.

- The United States is likely to recover sooner than Europe, but still has a way to go as necessary stimulus and tax restructuring is restricted by political machinations.

- Recovery from financially-induced recessions takes a long time as de-leveraging works its way through the global economy and as the 'paradox of thrift' has purchase in many advanced economies.

But let's get back to Australia. First Stevens canvasses the potential problems.

Rapid growth in Chinese demand for resources ... has been of great benefit to date, but what if the Chinese economy suffers a serious downturn? Another potential concern is dwelling prices ... A further theme is the focus on the funding position of Australian financial institutions, insofar as they raise significant amounts of money offshore. Could this be a weakness, in the event that market sentiment turns? ... It has long been a visceral fear among Australian officials and economists that global investors will suddenly take a dim view of us.

He then tells us we should welcome the sceptics and that some of their concerns might even be valid.

We should always be wary of the conventional wisdom being too easily accepted. We should never, ever, assume that ‘it couldn’t happen here’.

This new found openness to debate has been reflected in the RBA's recent concerns about the high value of the dollar. Sheesh, maybe, just maybe, there's a possibility that the RBA sees some validity in the idea of Dutch disease. Generally speeches from senior RBA and Treasury figures, not to mention that bastion of purist economic liberalism, the Productivity Commission, take the attitude of "get over it" or "welcome to the permanent future of never-ending Asian growth and mining largess".

Regular Gillard government critic Warwick McKibbin recently called for the RBA to intervene to decrease the value of the dollar and was himself criticised as an economic apostate.

Regular Gillard government critic Warwick McKibbin recently called for the RBA to intervene to decrease the value of the dollar and was himself criticised as an economic apostate.

But I digress. The Guv then considers a range of very pertinent questions that I've long been concerned about.

How much of the recent relatively good performance was due to luck? To what extent did we improve our luck by sensible policies, across a range of economic and financial fronts?

Are there signs of any of the things going wrong that people typically worry about?

And if there are, or were to be, such signs, could we do anything about it?

Despite these cautions, Stevens begins his analysis with three very relevant markers of Australia's above average performance. First up is GDP. As I argued recently in "Not Just Lucky, Good": "things could be worse. We could not be having a mining boom and we could have really bad economic policy-makers like those in the UK and Europe who believe that austerity is the solution to economic stagnation".

Great Britain might have won many more medals than us, but their economy is a basket case because the Conservatives have failed to read their history books and believe that cutting debt and public services is always the best solution to an economic crisis. I'm sure once the hoopla of the Olympics has died down, most Britons would rather have Australian economic conditions than British ones and would give up some of their medals for a better performing economy.

The good news is that it's not just in aggregate GDP growth that Australia has outperformed other developed economies but in GDP growth per capita and in unemployment rates.

Stevens' contention is that while there has been a bit of luck involved, there have also been some good policy decisions over the past 20 years or so, a view with which I would fully concur. But as any football player would note, the game ain't over til it's over. Unfortunately for this analogy, the economic game never ends.

The biggest immediate concern for Australia is a long-standing economic vulnerability - changes in international demand for our exports. These days that means mostly Asian and particularly Chinese demand.

Those of you that follow the global and domestic economic debate will be well aware that the big issue at the moment is the short to medium-term prospects of the Chinese economy. This debate matters a lot to Australians, because if China tanks, demand for our resources will also fall.

Particularly worrying is the decline in the price of iron ore. China accounts for 61.5 of global iron ore sales.

Particularly worrying is the decline in the price of iron ore. China accounts for 61.5 of global iron ore sales.

The latest Composition of Trade publication from DFAT lists Australia's main exports up to the end of 2011. Iron ore accounted for 20 per cent of all Australian exports. You don't have to be too smart to realise that a substantial price decline will have a big impact on Australian export income.

Generally over the last 5 years, resource exports have grown in importance at the expense of a more diversified export structure. Education 'exports' have fallen to fourth, now behind gold.

Generally over the last 5 years, resource exports have grown in importance at the expense of a more diversified export structure. Education 'exports' have fallen to fourth, now behind gold.

Stevens believes that China's slowing is a "a normal cyclical slowing, not a sudden slump of the kind that occurred in late 2008".

Others are not so sure that the problem is just cyclical. Michael Pettis, for example, argues in a recent (August the 6th) newsletter:

over the next three months we will see a rebound in Chinese GDP growth as investment expands. The leadership transition, after all, is in October, and no one in power wants to see the ten-year period under the leadership of President Hu and Premier Wen end with an economic whimper, especially after the very distressing political scandals we have lived through this year.

I don’t think, however, that any rebound or recovery will last more than one or two quarters, and even then it is going to be a very tedious and lop-sided recovery. ...

the only sure way to pump up the economy is for Beijing to encourage infrastructure spending at the local and municipal levels, a very inefficient kind of growth, and one which will probably spur even more real estate development. This pumps up unnecessary infrastructure investment, but little of the benefits end up with consumers or with the companies that serve them. Goosing infrastructure investment is, however, pretty much the only economic policy tool Beijing has ...

As I have outlined many times before on this blog, Pettis believes that there is severe pain ahead for China as it restructures its economy away from an investment-led economy to a more consumer-oriented economy. This transition is sometimes seen as a relatively straightforward transition, but it will create many losers amongst China's elite and will therefore no doubt be resisted by many of them.

Another reason for pessimism about China is the fact that the prospects for the export sector - a major source of Chinese growth - are also grim because of continuing global economic woes, with Europe particularly woeful.

Stevens is certainly amongst the optimists when it comes to China's prospects.

the Chinese authorities have been taking well-calibrated steps in the direction of easing macroeconomic policies, as their objectives for inflation look like being achieved and as the likelihood of slower global growth affecting China has increased. Prices for key commodities are lower than their peaks, but are actually still high.

So far, then, the ‘China story’ seems to be roughly on course. It is certainly true that we will feel the effects of the Chinese business cycle more in the future than we have been accustomed to in the past. That presents some challenges of economic analysis and management. But even so, it may be better to be exposed to a Chinese economy with a high average, even if variable, growth rate, than, say, to a Europe with a very low average growth rate that is apparently also still rather variable.

The last part of that analysis is definitely right. Let's say it again loud and clear: resources have not been a curse for Australia. They have made us richer, even if we could have done (and could do) a better job of distributing the benefits.

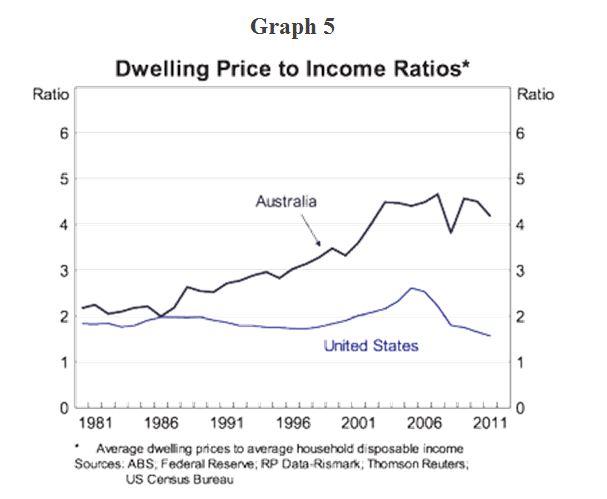

Another area where Stevens is a bit yeah, naah is on dwelling prices. Despite recent price falls, Australia has not had the bust that has occurred in many other developed countries.

Scaled to measures of income, Australian dwelling prices on a national basis have in fact declined and are now about where they were in 2002. That is, housing has become more ‘affordable’. Four or five years ago we supposedly had a housing affordability ‘crisis’. Now it seems that the problem some people fear is that of housing becoming even more affordable.

He then considers whether house prices are still over valued. Making comparisons with long-term averages or overseas prices are fraught with danger and basically involve guesses.

arguments that appeal to historical averages for such ratios lose potency the longer the ratio stays high. In Australia's case the ratio of prices to income on a national basis has been apparently at a higher mean level – about 4 to 4½ – for about a decade now.

If we compare Australia and the United States, Stevens contends that:

it is hard to avoid the impression that gravity will inevitably exert its influence on Australian dwelling prices. But if we put these two lines on a chart with a number of other countries with which we might want to make comparisons, the picture is much less clear.

Stevens argues that it is the United States that is the "outlier" and that we have more in common with the rest of the developed economies.

Another reason that Stevens is confident about housing (and also therefore about the banks) is that arrears rates remain low. Debt repayments as a percentage of income have declined. There is also a high proportion of mortgagees ahead on their payments. This factor together with the low unemployment rate is certainly on the yeah side of our equation.

Anecdotally, however, I know a lot of public servants in Queensland who are worried about their mortgages and job security given the Newman government's mindless and arbitrary slashing of public sector jobs. If repeated by an Abbott government it could contribute to the naah side of the equation just at the time as the economy is hit by a China slowdown!

Anecdotally, however, I know a lot of public servants in Queensland who are worried about their mortgages and job security given the Newman government's mindless and arbitrary slashing of public sector jobs. If repeated by an Abbott government it could contribute to the naah side of the equation just at the time as the economy is hit by a China slowdown!

As an aside, upon coming to power, the Howard Government argued it was necessary to reduce the size of the Commonwealth bureaucracy, so it cut staff savagely from 143,226 in 1996 to 113,627 in 1999. But in the early 2000s, the size of the public service began to grow again, and by 2006 it had surpassed the level of 1996 to reach 146,384 personnel. This is despite the additional high levels of outsourcing of government work. Between 2005 and 2006 the public service increased by 13,000 or 9.6 per cent compared to 1.7 per cent for the national workforce. Howard was often accused of being an unrestrained neo-liberal, but he certainly didn’t believe in small government.

The second long-term vulnerability that Australia faces alongside the potential for a decline in demand is an interruption to financial supply. This is important because Australia has a high level of foreign debt and the banks a high exposure to foreign lenders.

Stevens acknowledges that the banks engaged too heavily in borrowing short, lending long in the lead up to the GFC, but argues that they have been effectively moving away from this model.

Stevens acknowledges that the banks engaged too heavily in borrowing short, lending long in the lead up to the GFC, but argues that they have been effectively moving away from this model.

Stevens is also not worried at all about the current account deficit (CAD), a major worry of policy-makers in the 1980s and 1990s, but a non-issue for them since the 2000s.

while we have been told over the years how Australian banks were doing the country a favour by arranging the funding of the current account, they have stopped doing this over the past year without, apparently, any dramatic effects. As measured in the capital account statistics, there has been a net outflow of private debt funding over the past two years, offset roughly by increased inflow of foreign capital into government obligations. This has occurred with a net decline in government debt yields and a net rise in the exchange rate. The current account deficit has, in other words, been easily ‘funded’ without the assistance of banks borrowing abroad – in fact, while they have been net re-payers of funds borrowed earlier.

Not everyone agrees that the CAD cannot return as a key issue for the Australian economy, but it has definitely been removed from the forefront of the policy debate in recent years. Like many economic issues, concern will probably return as the deficit grows once again.

Stevens is also not particularly worried by our vulnerability to a decline in financial supply, although he doesn't dismiss it completely and nor should he. An Australian downturn together with another global credit crunch would be a very bad thing for a (private) debt exposed economy like Australia's.

Capital flows into Australia through foreign direct investment and more recently into Australian dollars generally have led to a higher dollar and a well funded current account deficit, but this too could change if new investment dries up and assessments about Australia's safe haven status become negative.

A financial collapse in Europe could lead to another global financial crisis, but Australia would have room to move on fiscal policy if the government (of whatever stripe) can overcome the negative politics of public debt increases.

The RBA, of course, still has room to move on interest rates, which would give households with mortgages more disposable income. If a credit crunch was mixed with a slowdown in China and rising unemployment then conditions would be tough in Australia, but still better than in most other developed economies.

A financial collapse in Europe could lead to another global financial crisis, but Australia would have room to move on fiscal policy if the government (of whatever stripe) can overcome the negative politics of public debt increases.

The RBA, of course, still has room to move on interest rates, which would give households with mortgages more disposable income. If a credit crunch was mixed with a slowdown in China and rising unemployment then conditions would be tough in Australia, but still better than in most other developed economies.

It's also possible that a worsening of the European situation could actually lead to an increase of capital flows to Australia, which wouldn't be a problem for the banks, but would be for manufacturing, domestic tourism and other trade exposed sectors of the economy through Dutch disease effects.

Stevens appears to have significant faith in the Chinese Communist Party to manage the Chinese economy and with the leadership transition pressures to keep the economy humming will be high. Nevertheless, the high investment, low consumption growth model is unsustainable over the longer-term and we have to hope those communists get it right.

Overall, Stevens is right to be more yeah than naah about the Australian economy, but we shouldn't lose sight of economic vulnerabilities both short and long-term. We need a flexible economy that remains diversified.

We also need to remember that the redistribution of resources and opportunity across Australian society is necessary to maintain popular support for a dynamic open economy.

No comments:

Post a Comment

Please be civil ...