One of the most interesting economic publications the ABS puts out is 5352.0 - International Investment Position, Australia: Supplementary Statistics. Recently they released individual country data on investment in and out of Australia for calendar year 2009.

Many people who keep up with the business and economic news would be forgiven for thinking that Chinese investment in Australia is more important than investment from elsewhere, but what this publication reveals is just how dominant the US and the UK remain for Australian investment.

Foreign Investment in Australia

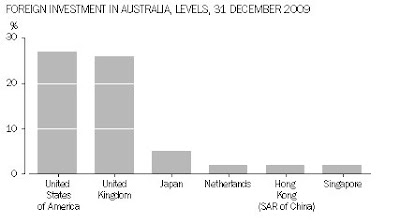

Stocks at End of 2009

Australia’s net international investment position at 31 December 2009 was $767.3 billion, an increase of $62.2 billion on the previous year.

The level of foreign investment in Australia increased by $136.1 billion to reach $1,897.7 billion at 31 December 2009.

Portfolio investment accounted for $1097.8 billion (58%) [both debt and equity]

Direct investment for $436.1 billion (23%) [investment in a company greater than 10 %]

Other investment liabilities for $284.8 billion (15%) and

Financial derivatives for $78.9 billion (4%).

Of the portfolio investment liabilities, debt securities accounted for $728.9 billion (38%) and equity securities for $369.0 billion (19%).

The leading investor countries at 31 December 2009 were:

In addition, the level of borrowing raised on international capital markets (e.g. Eurobonds) was $93.1 billion or 5%.

- United States of America ($514.3 billion or 27%);

- United Kingdom ($498.6 billion or 26%);

- Japan ($102.0 billion or 5%);

- Netherlands ($43.4 billion or 2%);

- Hong Kong (SAR of China) ($43.2 billion or 2%);

- Singapore ($40.2 billion or 2%).

53% of inward investment in Australia has come from our former great and powerful friends. Despite the growth of Chinese investment it still doesn't break the 2% barrier.

The above stats are for stocks of investment in Australia built up over time until the end of 2009. What about the amount of investment that flowed into Australia during 2009?

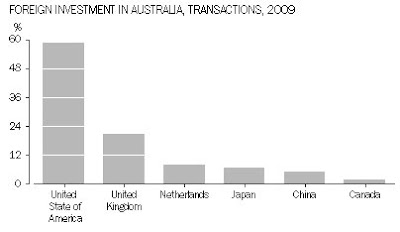

Flows in 2009

Foreign investment in Australia recorded a net inflow of $159.5 billion for the year ended 31 December 2009, an increase of $12.0 billion on the net inflow of $147.5 billion for the previous year.

The leading investor countries were:

- United States of America ($93.8 billion or 59%);

- United Kingdom ($33.9 billion or 21%);

- Netherlands ($12.9 billion or 8%);

- Japan ($11.4 billion or 7%);

- China ($7.8 billion or 5%);

- Canada ($3.3 billion or 2%)

Here China gets on the board with 5% of investment into Australia during 2009. But most interesting is the relative importance of US investment in comparison at 59%! Japanese investment, which used to be controversial comes in at 7%, 2% higher than Chinese investment but attracting very little comment at all.

Australian Investment Abroad

Stocks at End of 2009

The level of Australian investment abroad reached $1,130.4 billion at 31 December 2009, an increase of $73.9 billion on the previous year.

Portfolio investment abroad accounted for $430.1 billion (38%)

Direct investment for $344.6 billion (30%)

Other investment for $220.2 billion (19%)

Reserve assets for $45.3 billion (4%)

Financial derivatives for $90.2 billion (8%).

Equity has been the main form of Australian investment abroad during the past decade. At $584.5 billion, equity represented 52% of the total level of investment at 31 December 2009.

The leading destination countries as at 31 December 2009 were:

- United States of America ($403.7 billion or 36%);

- United Kingdom ($178.7 billion or 16%);

- New Zealand ($79.8 billion or 7%);

- Germany ($37.7 billion or 3%);

- Canada ($36.8 billion or 3%);

- Japan ($31.6 billion or 3%).

Flows in 2009

Australian investment abroad recorded a net outflow of $104.1 billion for the year ended 31 December 2009, an increase of $11.5 billion on the net outflow of $92.6 billion for the previous year.A massive 72% of Australian investment went to the United States. No Asian country makes it into the top 5. While we increasingly trade with Asia we still remain wedded to the US and Europe for investment. Such figures give the lie to the fact that investment necessarily flows from developed to developing countries. Most investment still takes place between developed economies and although I haven't checked more recent figures, on a net basis investment flows from the developing world to the developed world.

The leading destination countries were:

- United States of America ($74.5 billion or 72%);

- Germany ($13.3 billion or 13%);

- New Zealand ($5.5 billion or 5%);

- Canada ($3.7 billion or 4%);

- Belgium ($3.6 billion or 3%);

- Luxembourg ($3.6 billion or 3%).

Nothing like looking at the statistics to get some perspective beyond the media cycle.

Tom I totally agree with you. This China Myth needs to be put to rest.

ReplyDeleteIn the end, Chinese foreign investment is mostly concerned with procuring raw resources. The investment of technical resources is still very much one sided. The media view of China is flat wrong, as is the view of most western economist. The country is an economic basket case. Anyone who has lived there outside of Bejing and the coastal hubs will normally agree. Its is and continues to grow at 'inflated' levels due to the piss poor conditions in most of the country. Australia should not bank on the future success of China, the country will be undermined in the medium term by its disastrous environmental conditions.