Asia will be a long-term benefactor of Australian prosperity according to virtually all Australian economic policy-makers and commentators. Some like RBA governor Glenn Stevens and Treasury Secretary Ken Henry argue that there will be some problem associated with this ‘politics of prosperity’ but generally they do not consider it possible that either growth in Asia could slow or that demand for Australian resources could be negatively affected by increases in supply from elsewhere or technological changes. So-called ‘black swan’ events – war, terrorism, political unrest, environmental or natural catastrophe are not considered at all and I suppose that’s fair enough at one level. We can’t spend our entire lives preparing for the worst of all cases.

Probably the best coverage of the assumption that ‘Asian non-drama’ will be beneficial for Australia comes from Philip Lowe Assistant Governor (Economic) with the RBA. (See Philip Lowe (2009) “The Growth of Asia and Some Implications for Australia”,

Talk to Citi Australia Inaugural Australian Investment Conference, Sydney, 19 October <

http://www.rba.gov.au/Speeches/2009/sp-ag-191009.pdf>.)

Lowe begins by pointing out that Australia has done better than virtually any other developed country in the world, noting that Australia is the only country to not record a decline in exports. This good performance he argues was shaped by prescient monetary and fiscal policy, the “healthy state of the banking system” and “Australia’s trade links with Asia”.

His main concern he argues is with “medium-term structural issues”.

My central theme is that there are reasonable grounds for optimism about the prospects for the Australian economy over the decade ahead. There are a number of reasons for this, but the one that I would like to discuss today is our growing trade links with Asia.

Economic weight has shifted to Asia and because much of Asia is in a developmental mode it will require considerable resource development. When starting from a low base growth can be very rapid indeed.

Asia’s share of world GDP was only 7 per cent of GDP in 1990 (at market exchange rates, more if we use purchasing power parity – see my book Chapter 3 for explanation). This increased to around 15 per cent by 2008. Growth in East Asia has averaged 7 per cent a year during this period compared to 2 per cent for the developed world.

As far as industrial production goes Asia has done even better, especially China. In 1990 China’s share of industrial production was 2 per cent, in 2008 the figure was 13 per cent.

Lowe summarises the situation thus:

The general picture here is pretty clear: there has been very strong growth in Asia, with the economies of the region now accounting for a significant share of world output. And looking forward, there is a high probability that this will continue over the years ahead. As an illustration of the ongoing shift, recent growth projections from the IMF suggest that by 2014, the total amount of fixed asset investment in the developing world – much of which will occur in Asia – will be the same as that in the advanced economies (Graph 4). This would be a remarkable change from the situation just a decade ago when the level of investment in the developing world was only one third of that in the developed world. The change that is going on here reflects the subdued prospects for many of the advanced economies, the high pace of growth in Asia, and the current high rates of investment in many Asian countries.

Note that the assumption here is that what has happened over the past few years is expected to continue and the graph below is an estimate beyond 2008.

But the real issue here is the extent to which growth and investment in Asia is dependent on growth in the developed world. As Lowe notes demand in developed economies is likely to be weak over coming years because of the high level of indebtedness among households. (This is also true of Australia, where the debt to disposable income ratios is about 160 per cent. This is the highest ever by a long shot.). But it is not just households that are indebted, now because of the global recession governments are increasingly indebted as well. Lowe notes that: “net public-sector debt to GDP for the G7 countries is likely to exceed 90 per cent within a few years, an outcome that has not previously been seen outside of periods of war”. (See the previous post on public debt)

This takes us back to the debate about ‘decoupling’ that was seemingly won by the anti-decouplers during the financial crisis and the early stages of the global recession. Basically, the de-coupling thesis argued that Asia and Europe (but particularly China) would be less affected by events in the US economy and financial system. The anti-decouplers correctly pointed out that Asia was negatively affected by the greatest collapse of trade since the Great Depression. Indeed for a time, there seemed to be some suggestion that the export-led model was dead. European financial markets were devastated by the flow on effects of US developments (particularly the UK) and exporters like Germany were severely affected by the collapse of world trade as well. The de-couplers, however, now claim some vindication given China’s amazing growth performance built on the back of one of the biggest government stimulus packages of all time. As they say, the jury is still out. But the major question is what will happen when governments remove monetary and fiscal stimulus.

These are short-to-medium-term concerns, Lowe's main concerns are the medium-to-long-term implications of developments in Asia. He tries to navigate a middle-way in the de-coupling debate:

Slower growth in the advanced economies will inevitably weigh on growth in Asia. The business cycles of the major regions of the world are clearly interconnected, and the ups and downs in one part of the world have an effect in other parts of the world.

But importantly this is not the end of the story. These interconnections do not mean that Asia must inevitably experience a marked reduction in its medium-term growth trajectory. As we have seen recently, the region has the capability to grow strongly through domestic, not external, demand. This really should not come as a surprise.

After all, the US economy, with a few hundred million people, has grown for many decades largely on the back of domestic, rather than foreign, demand. There is no reason that the approximately 3½ billion people in Asia cannot do the same. It ultimately comes down to the policy choices that are made.

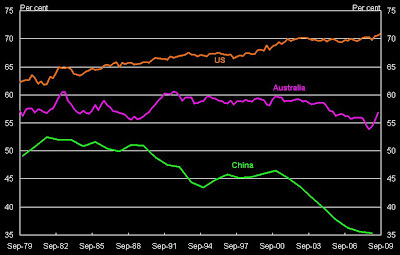

The last paragraph is a big call and consumption in Asia (China) is unlikely to match that of the West, particularly the United States, anytime soon. A chart presented by David Gruen from Treasury in a presentation entitled

“Global Imbalances: How much adjustment will we see?” (at the In the Zone Conference at the University of Western Australia on 9 November 2009), shows why this is a problematic assumption.

US consumption accounts for about 18 per cent of global GDP, Chinese consumption is less than 3 per cent at market exchange rates.

Lowe acknowledges that there are long-term structural issues that need to be addressed in China and the rest of Asia for sustained increases in domestic demand to occur.

Here, there is a reasonably broad consensus as to the types of policy steps that could be made over the medium term, although the specifics clearly differ from country to country. One possibility is continuing liberalisation of the services sector, which has the potential to grow strongly in many countries in the region. Another is reform of retirement incomes policies to give people more confidence that they will have sufficient income in their old age. A third possibility is further development of the financial sector so that savings can be most efficiently allocated to those who can make best use of them.

These are all rather long-term structural issues but gradual progress on these fronts can help form the basis for sustainable growth in domestic demand over the medium term in many of the countries of the region. There is also considerable scope for high levels of infrastructure investment in many of these countries, and the process of technology convergence has much further to run. And many of the countries of Asia are devoting increasing resources to education to improve the average productivity of their workforces.

Lowe then turns to the impact on Australia and notes that our 4 biggest merchandise export markets (i.e. not including services exports such as education and travel services – the third and fifth biggest exports) are all in Asia. The graphic is particularly revealing about the rise of China’s share.

The shift towards Asia has undoubtedly been a benefit during the global recession. As Lowe acknowledges:

Despite global trade falling by nearly 20 per cent over the past year, the volume of Australian exports stayed broadly flat over this period. The strong recovery in China saw demand for raw materials rebound strongly, and Australian producers were able to respond quickly. A number of other commodity exporting countries whose major customers are in Europe and North America have, until very recently, had less favourable experiences.

Growth in Asia has helped commodity prices to stay high despite the worst global economic downturn since the Great Depression. Many commentators including myself thought that commodity prices would have collapsed further (and they still might) but the fact that they haven’t has been a bonus for Australia. Most commentators, including those in the mining sector itself, now believe that the boom will continue onwards and upwards, making a mockery of historical precedents for collapses in prices.

Lowe then turns to investment pointing out, as have Henry and Stevens in recent times, that Australia is a high investment country. In the past year, investment has reached 17 per cent of GDP – the highest on record. Almost a third of it has, not surprisingly, been in the resources sector. Australia’s growing capital stock during a global recession is a remarkable performance.

According to estimates based on ABS data, mining investment was the equivalent of almost 5 per cent of GDP over the past year, a record by a large margin. While we had booms in the mining sector in the late 1960s and the early 1980s, these look relatively small compared with the current one. Over the past couple of years, we have had particularly high rates of investment in both the iron ore and coal industries and this is now starting to show up in export volumes. For example, the volume of iron ore exports has risen by around a third over the past two years, as new mine and port capacity has come on stream, and further increases are likely.

Lowe argues that this high level of investment will continue, given the huge deals on LNG made recently for long-term supply contracts for China, Japan and India.

Such developments make the sort of shrill commentary from some business journalists that Australia needs to alter the discretionary elements of its foreign investment review process or suffer the consequences seem rather ridiculous. Australia should continue to review large-scale investments in its resource assets to make sure that they produce the greatest gain for the Australian people.

Australia’s prospects are undoubtedly better than virtually all other developed countries at the moment. But we still need to think about how to reduce our vulnerability to a downturn in commodities.