Tuesday, October 30, 2012

Tuesday, October 16, 2012

Twelfth or Eighteenth? Measuring Australia's Economic Weight

No one could accuse Australia's politicians and economic bureaucrats of being shy or inscrutable when it comes to analysing the Australian economy. Treasury and the Reserve Bank provide regular commentary on the current state and future prospects of the Australian economy and make a wealth of statistical information freely available.

Some commentators argue that Treasury and the Reserve Bank of Australia are too optimistic about Australia's economic prospects, but having read most of the commentary that has been produced in recent years by economic policy-makers I think that there is a certain amount of hedging going on. The RBA Governor says that "Australia's glass is at least half full".

At the most basic level, policy-makers are optimistic because they believe that current shift of economic weight to China and emerging economies generally will continue indefinitely into the future. In other words, the belief is that future performance will be consistent with past performance.

Members of the Gillard government, as you would expect, are also regular contributors to economic debate hoping that advertising the success of the Australian economy will reverse the government's poor showing in opinion polls.

Treasurer Wayne Swan recently noted that Australia was now the world's twelfth largest economy and that during Labor's period of office it had moved up 3 places, whilst during the Howard government's tenure it lost 3 places.

If economies are measured on a USD exchange basis, then if a country's currency appreciates against the USD then the economy 'increases' in size as well.

If the Australian dollar were to fall substantially over coming years, other things being equal, the 'size' of our economy would also decrease.

This US dollar exchange measurement, therefore, is clearly only a partial way to measure the real size of economies, let alone wealth or development.

Swan bases his projections on the IMF's World Economic Outlook Database, the latest of which has just been released. The figures for 2012 are estimates, obviously, and the IMF provides further estimates out to 2017.

China is half the size of the United States on a USD basis compared to a little over three-quarters on a PPP basis. Measured by PPP, China is estimated to overtake the United States by 2017, but on a USD exchange basis it would still remain substantially smaller (21.3 per cent of the total for the US and 14.3 per cent of the total for China in 2017).

The IMF only makes estimates out to 2017, but the general impression is that China is inevitably destined to overtake and then leave the United States in its wake.

According to the latest PPP estimates for 2012, India has passed Japan as the world's third largest economy, although in terms of the USD measurement its economy remains less than half the size of the Japanese economy and only 10th overall only 2 places above Australia (2.7 per cent compared to 2.2 per cent of the total).

In 2017 (PPP), India is projected to leave Japan behind, although it will still only be a third of the economic weight of China. Australia falls slightly to 1.1 per cent of the total.

In 2017(USD), India will be 6th, just behind Brazil. Australia will move to 13th one place behind Indonesia.

Since 1990, Japan has fallen rapidly down the league table of economies as more than 20 years of slow growth and recession have taken their toll. The World Bank online databases only go back to 1999 and projections were only made at this time for one additional year, but we can be reasonably sure that projections based on past performance would have had Japan challenging the United States for supremacy in the 1990s based on 1980s performance.

Paul Krugman, writing in 1994, noted that: “at the growth rate of 1963-73,Japan would overtake the United States in real per capita income by 1985, and total Japanese output would exceed that of the United States

While China and Japan have profoundly different political economies, assertions about inevitability and irreversibility seem to have a horrible habit of coming unstuck.

Australia is twelfth, as Swan suggests, in terms of the USD measurement, but 18th on PPP terms, just behind Iran. With the recent collapse of the Iranian currency, it is unlikely that Iran will score so well on a USD basis in coming measures.

Recently, Secretary to the Treasury Martin Parkinson argued that Australia now has a smaller economy than Indonesia's, but this is only true if measured via PPP. In terms of USD it still has a smaller economy than Australia's (2.2 per cent of the total compared to Indonesia's 1.3.

Based on current projections Indonesia will have a slighter larger economy than Australia's in terms of US dollar exchange in 2017. Of course this might well change if the Australian dollar falls relative to the US dollar in coming years, as it probably will. This relativity will depend as well on what the Indonesia rupiah does against the US dollar in the next few years.

Over time, of course, PPP indexes must also be recalculated and these undertaken by the International Comparison Program of the World Bank. As economies develop, the costs of living and production increase, making even PPP comparisons problematic at best and inaccurate at worst.

It suits Wayne Swan to use the USD exchange measurement - twelfth sounds much better than eighteenth - and it suits Parkinson to use PPP to make his points that emerging economies are now a much more important part of the global economy, and that Indonesia might leave us behind if we don't improve our productivity and tax system.

What this all means is that measures of economic weight should be taken as indicative rather than absolute and that future projections should carry the same warning as investment products that "past performance is no guarantee of future results".

Economic 'progress' is another thing entirely and we need to consider measures such as GDP per capita, human development and environmental sustainability to get a more accurate picture of the state of play.

For GDP per capita, the distinction between the two methodologies is significant with Australia ranking 6th on a USD exchange basis and 15th on a PPP basis in 2011.

On the Human Development Index, which includes a range of including life expectancy, literacy, education and GDP per capita, Australia ranks second behind Norway. In the 2011 HDI rankings, China came 101st, Indonesia 124th and India 134th.

Improvements in productivity - the efficiency of labour and capital - and an egalitarian distribution of the fruits of that productivity are what matters for the long-term. Getting our policy-makers and the wider population to realise that the two are not contradictory is the short-term challenge.

Some commentators argue that Treasury and the Reserve Bank of Australia are too optimistic about Australia's economic prospects, but having read most of the commentary that has been produced in recent years by economic policy-makers I think that there is a certain amount of hedging going on. The RBA Governor says that "Australia's glass is at least half full".

At the most basic level, policy-makers are optimistic because they believe that current shift of economic weight to China and emerging economies generally will continue indefinitely into the future. In other words, the belief is that future performance will be consistent with past performance.

Members of the Gillard government, as you would expect, are also regular contributors to economic debate hoping that advertising the success of the Australian economy will reverse the government's poor showing in opinion polls.

Treasurer Wayne Swan recently noted that Australia was now the world's twelfth largest economy and that during Labor's period of office it had moved up 3 places, whilst during the Howard government's tenure it lost 3 places.

In the past five years Australia’s economy has surpassed the economies of South Korea, Mexico and now Spain. Our economy has grown around 11 per cent since the end of 2007 while the US has grown only around 1¾ per cent and many European countries are still substantially smaller due to the massive recessions they have suffered. Inhabiting a place among the top dozen largest economies on the planet is particularly impressive when you consider that we have only the 51st biggest population.This is a truly impressive performance, but one of the reasons we've improved our ranking is because of the appreciation of the Australian dollar against the US dollar. In 2007, the Australian dollar averaged 83.89 US cents compared to an average of 103.43 cents in 2012 up to the 12th October.

If economies are measured on a USD exchange basis, then if a country's currency appreciates against the USD then the economy 'increases' in size as well.

If the Australian dollar were to fall substantially over coming years, other things being equal, the 'size' of our economy would also decrease.

This US dollar exchange measurement, therefore, is clearly only a partial way to measure the real size of economies, let alone wealth or development.

Swan bases his projections on the IMF's World Economic Outlook Database, the latest of which has just been released. The figures for 2012 are estimates, obviously, and the IMF provides further estimates out to 2017.

An alternative way of measuring the size of economies is by purchasing power parity (PPP). According to Vogel:

A PPP index provides a way to convert national accounts to a common currency - called Geary-Khamis or international dollars - based on purchasing power. GDP is adjusted to reflect different costs of living and production within different economies. As most travellers and international investors know, goods and services and production costs are considerably lower in some countries than they are in others. The most widely known index is The Economist's Big Mac Index and there is an iPod Index as well. Both are gross oversimplifications of PPP.A purchasing power parity (PPP) is a price index very similar in content and estimation to the consumer price index, or CPI. Whereas the CPI shows price changes over time, a PPP provides a measure of price level differences across countries. A PPP could also be thought of as an alternative currency exchange rate, but based on actual prices.

If we consider the top 20 countries on PPP and USD terms we get vastly different results.

The IMF calculates the GDP share of the total for every economy on a PPP basis, but the USD figures have to be constructed. For both tables I have ranked countries on the basis of their 2012 'results'.

The IMF calculates the GDP share of the total for every economy on a PPP basis, but the USD figures have to be constructed. For both tables I have ranked countries on the basis of their 2012 'results'.

China is half the size of the United States on a USD basis compared to a little over three-quarters on a PPP basis. Measured by PPP, China is estimated to overtake the United States by 2017, but on a USD exchange basis it would still remain substantially smaller (21.3 per cent of the total for the US and 14.3 per cent of the total for China in 2017).

The IMF only makes estimates out to 2017, but the general impression is that China is inevitably destined to overtake and then leave the United States in its wake.

According to the latest PPP estimates for 2012, India has passed Japan as the world's third largest economy, although in terms of the USD measurement its economy remains less than half the size of the Japanese economy and only 10th overall only 2 places above Australia (2.7 per cent compared to 2.2 per cent of the total).

In 2017 (PPP), India is projected to leave Japan behind, although it will still only be a third of the economic weight of China. Australia falls slightly to 1.1 per cent of the total.

In 2017(USD), India will be 6th, just behind Brazil. Australia will move to 13th one place behind Indonesia.

Since 1990, Japan has fallen rapidly down the league table of economies as more than 20 years of slow growth and recession have taken their toll. The World Bank online databases only go back to 1999 and projections were only made at this time for one additional year, but we can be reasonably sure that projections based on past performance would have had Japan challenging the United States for supremacy in the 1990s based on 1980s performance.

Paul Krugman, writing in 1994, noted that: “at the growth rate of 1963-73,

While China and Japan have profoundly different political economies, assertions about inevitability and irreversibility seem to have a horrible habit of coming unstuck.

Australia is twelfth, as Swan suggests, in terms of the USD measurement, but 18th on PPP terms, just behind Iran. With the recent collapse of the Iranian currency, it is unlikely that Iran will score so well on a USD basis in coming measures.

Recently, Secretary to the Treasury Martin Parkinson argued that Australia now has a smaller economy than Indonesia's, but this is only true if measured via PPP. In terms of USD it still has a smaller economy than Australia's (2.2 per cent of the total compared to Indonesia's 1.3.

Based on current projections Indonesia will have a slighter larger economy than Australia's in terms of US dollar exchange in 2017. Of course this might well change if the Australian dollar falls relative to the US dollar in coming years, as it probably will. This relativity will depend as well on what the Indonesia rupiah does against the US dollar in the next few years.

Over time, of course, PPP indexes must also be recalculated and these undertaken by the International Comparison Program of the World Bank. As economies develop, the costs of living and production increase, making even PPP comparisons problematic at best and inaccurate at worst.

It suits Wayne Swan to use the USD exchange measurement - twelfth sounds much better than eighteenth - and it suits Parkinson to use PPP to make his points that emerging economies are now a much more important part of the global economy, and that Indonesia might leave us behind if we don't improve our productivity and tax system.

What this all means is that measures of economic weight should be taken as indicative rather than absolute and that future projections should carry the same warning as investment products that "past performance is no guarantee of future results".

Economic 'progress' is another thing entirely and we need to consider measures such as GDP per capita, human development and environmental sustainability to get a more accurate picture of the state of play.

For GDP per capita, the distinction between the two methodologies is significant with Australia ranking 6th on a USD exchange basis and 15th on a PPP basis in 2011.

On the Human Development Index, which includes a range of including life expectancy, literacy, education and GDP per capita, Australia ranks second behind Norway. In the 2011 HDI rankings, China came 101st, Indonesia 124th and India 134th.

Improvements in productivity - the efficiency of labour and capital - and an egalitarian distribution of the fruits of that productivity are what matters for the long-term. Getting our policy-makers and the wider population to realise that the two are not contradictory is the short-term challenge.

Thursday, October 11, 2012

Queensland Employment Compared

If you thought things felt a little crappy in Queensland on the jobs front you'd be right. This from MacroBusiness's Leith van Onselen. Western Australia powering ahead.

Maybe cutting so hard, so quickly on public sector jobs wasn't the right thing to do right now.

Still they'll need to re-employ all those people reasonably soon either back as public servants or as consultants.

Should be good for those graduating in 2-3 years time.

Maybe cutting so hard, so quickly on public sector jobs wasn't the right thing to do right now.

Still they'll need to re-employ all those people reasonably soon either back as public servants or as consultants.

Should be good for those graduating in 2-3 years time.

Wednesday, October 10, 2012

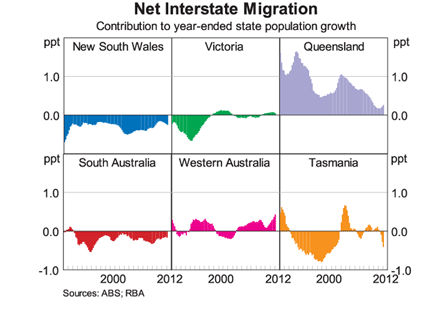

Net Interstate Migration

A graph from a recent speech by Philip Lowe Deputy Governor of the Reserve Bank entitled "The Labour Market, Structural Change and Recent Economic Developments" provided an interesting graph of interstate migration over the past years.

As Lowe points out:

The rate of net migration to Queensland has slowed considerably over the past few years, while NSW is the only state to suffer from net losses over the entire 20 or so year period.

As Lowe points out:

the rate of net interstate migration to Western Australia over the past year is the highest for around 25 years. It is also worth noting that interstate migration has played an important role in the Tasmanian economy, with the situation switching from sizable net inflows to net outflows and back again over the course of just a few years. For a period in the 2000s, internal migration was adding around ½ per cent to Tasmania's population annually. Today, it is subtracting almost this amount.

The rate of net migration to Queensland has slowed considerably over the past few years, while NSW is the only state to suffer from net losses over the entire 20 or so year period.

Tuesday, October 9, 2012

Subscribe to:

Comments (Atom)